And it’s official. Rivian (RIVN) will lose its position on the Nasdaq-100 index (NDX) after its stock price fell over 90% from its all-time high achieved shortly after going public.

Rivian to be removed from the Nasdaq-100 index

Less than two weeks after JP Morgan analyst Min Moon predicted in a note to investors that Rivian would lose its position in the Nasdaq-100, it’s becoming a reality.

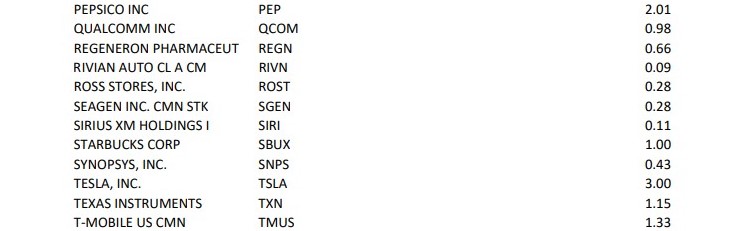

Moon explained that the Nasdaq-100, a stock market index of the 100 largest nonfinancial companies listed on the exchange, generally removes the smallest member of the group if the company is weighted at less than 0.1% for two straight months.

Rivian was below the 0.1% mark on April 28 and May 31, leading Moon to believe the move was inevitable. Moon also correctly predicted the company set to replace Rivian: On Semiconductor, which was ranked the top eligible company.

Nasdaq confirmed Tuesday it would be replacing Rivian with On Semiconductor Corp. (ON) on the Nasdaq-100 index.

Rivian is also losing its position in the Nasdaq-100 ESG index, the Nasdaq-100 Equal-Weighted index, and the Nasdaq-100 Ex-Tech sector index. The move will happen Tuesday, June 20, 2023.

Despite the news, Rivian stock climbed nearly 9% in Tuesday’s trading session, with several EV stocks also rising.

Electrek’s Take

Losing its spot in the index shouldn’t be a huge deal for Rivian. However, it is important to note being removed means all shares held by the index will be sold and replaced with the new company (in this case, On Semiconductor).

Although Rivian’s stock is up nearly 20% over the past month, it’s still down over 90% from its all-time high of over $170 per share, set within a week of its IPO.

With lower stock prices, Rivian, like most EV startups (and unprofitable growth stocks in general), has lost the ability to raise cheap funding through equity raises. This funding issue, combined with rising input costs, is straining margins.

Despite this, Rivian was among the few automakers to reaffirm its annual production goal of 50,000 units after the first quarter.

The EV maker produced 9,395 EVs in the first three months of the year while delivering 7,946 during the same period.

CEO RJ Scaringe says driving profitability is just as important as ramping production now after initiating a wave of cost-cutting measures over the past year or so.

With its second-gen EV models (R2), due out in 2026, Rivian expects to significantly improve margins with a simplified manufacturing process and components.

FTC: We use income earning auto affiliate links. More.

Comments