Bollinger Motors’ B4 chassis cab EV gets IRS approval for up to $40,000 in federal tax credits

Two years after pivoting its business strategy toward the development of commercial EVs, Bollinger Motors has earned IRS approval for federal tax credits under the Inflation Reduction Act, offering fleet customers potential tax credits up to 40,000 per vehicle.

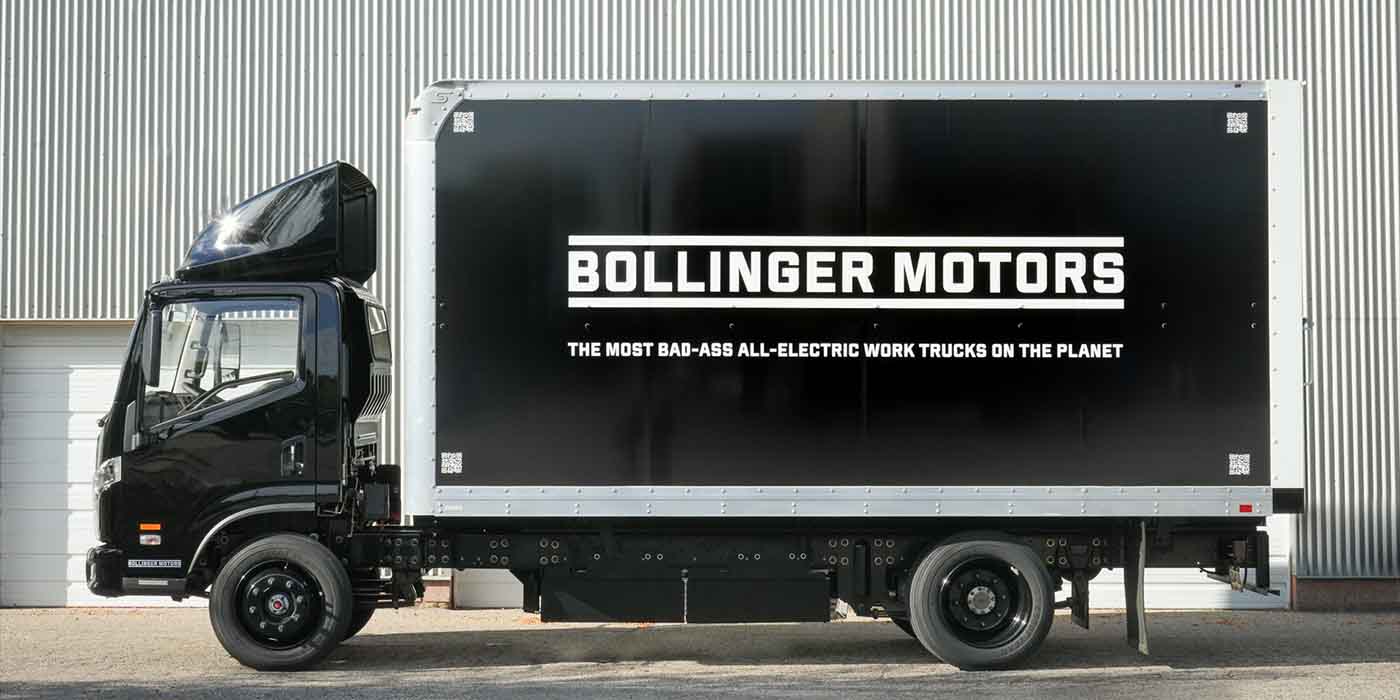

Expand Expanding Close