Tesla (TSLA) is set to announce its fourth-quarter 2020 and full-year financial results tomorrow, January 27, after the markets close. As usual, a conference call and Q&A with Tesla’s management is scheduled after the results.

We’ll take a look below at what both the street and retail investors are expecting for the quarterly results.

Tesla Q4 2020 deliveries

As usual, Tesla’s vehicle deliveries drive most of its earnings results, since vehicle sales represent the automaker’s main revenue stream at the moment.

Tesla already released its Q4 2020 numbers confirming that it delivered 180,570 cars and produced more than 179,757 vehicles between October and December 2020.

That’s not only a new record in deliveries, but it beats the last record, which was achieved just in the previous quarter, by about 40,000 electric cars.

Delivery and production numbers are always slightly adjusted during earning results.

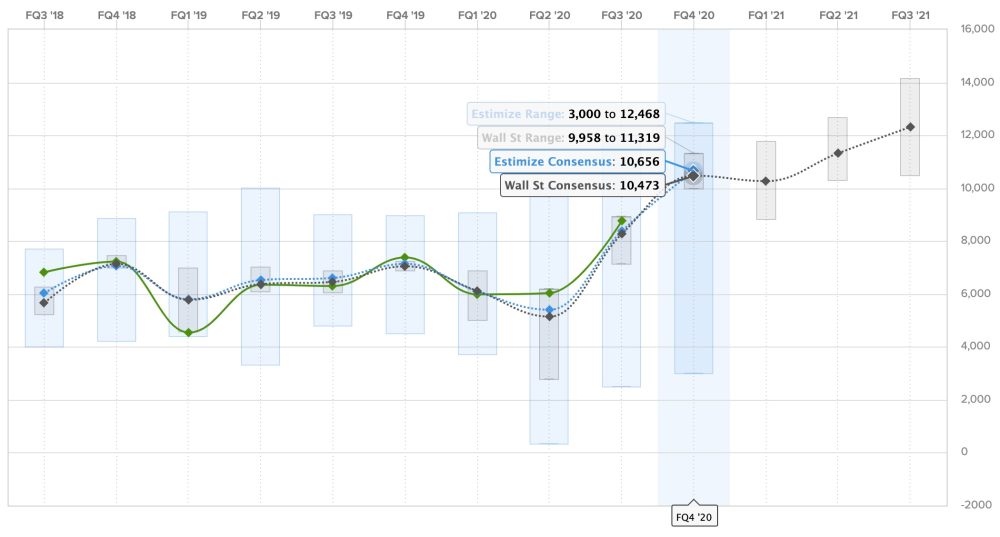

Tesla Q4 2020 revenue

With such an increase in deliveries, Wall Street’s revenue consensus for Tesla during the fourth quarter has significantly increased over last quarter.

It now stands at $10.473 billion, and Estimize, the financial estimate crowdsourcing website, predicts a higher revenue of $10.656 billion.

That’s about $2 billion more than what delivered during the previous quarter, which also was a record.

The predictions for Tesla’s revenue over the past two years: Estimize predictions are in blue, Wall Street consensus are in gray, actual results are in green:

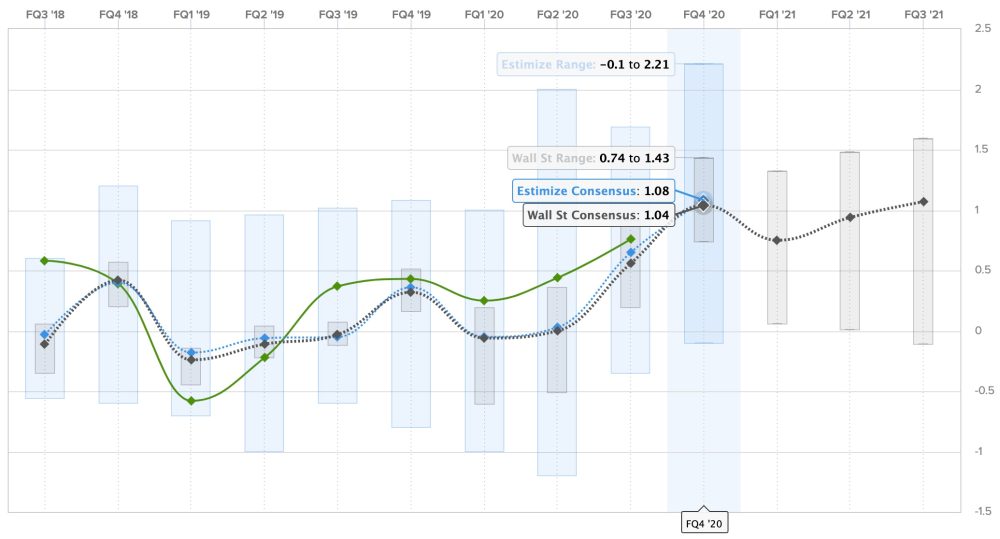

Tesla Q4 2020 earnings

Tesla has been consistently beating earnings expectations over the last year, and this quarter, with the big revenue increase expected, the market has also significantly increased its expectations when it comes to earnings.

The Wall Street consensus is a gain of $1.04 per share for the quarter, while Estimize’s prediction is slightly higher with a profit of $1.08 per share.

Those predictions are roughly double what they were last quarter and also higher than Tesla’s results of $0.76 per share.

Earnings per share over the last two years: Estimize predictions in blue, Wall Street consensus in gray, actual results in green:

Other expectations for the TSLA shareholder’s letter and analyst call

While the fourth quarter and the full-year 2020 have brought a lot of records for Tesla, I don’t think it’s going to be a major focus of the results and call tomorrow.

I think the market is going to be looking at Tesla delivering a profit on this new record delivery of 180,000 cars, but after that, the market is going to turn its attention to 2021 projections.

People are going to want to know if Tesla can keep this record-breaking momentum, and that means a projection for how many cars it can deliver in 2021.

I’ve seen anything between 700,000 to 1.2 million vehicles estimated by industry watches.

A big contributor to Tesla’s growth in 2021 is going to be Model Y in Shanghai, which just launched, and investors are going to want to know how that is going.

Start of production at Gigafactory Berlin is also going to be an important contributing factor, but that’s a little further out.

Nonetheless, investors will likely also be looking for an updated timeline on that front during the calls.

Finally, the same thing for Gigafactory Austin, but that’s also more for the second half of the year.

The production ramp-up of Model Y production at all these plants and the capacity to secure the battery cell supply to support that production are going to determine Tesla’s growth in 2021.

The problem with that is that even Tesla has limited visibility into those production ramps.

With the new year, investors will also probably look for potential timeline updates on Tesla Semi, Tesla Cybertruck, and Tesla Roadster – though I wouldn’t hold my breath for those as the focus is still very much on ramping up Model Y.

An update on the rollout of Full Self-Driving Beta is also likely to come with the results as the timeline has slipped on that front.

Lastly, on the vehicle front, investors will be looking for an update on Model S and Model X following the production shutdown and expectations of a refresh. Tesla might not comment on that during the earnings as it doesn’t generally make product announcements during those financial releases and calls, but the automaker might make an exception in this case due to the timing.

On the energy front, I’d be looking for another record deployment of energy storage and a continued recovery of solar deployment.

It won’t contribute significantly to Tesla’s earnings, but a good performance on that front would set the company up for a good year in energy in 2021.

What else are you looking for during Tesla’s earnings? Let us know in the comments section below, and join us tomorrow afternoon for an extensive coverage of the earnings.

FTC: We use income earning auto affiliate links. More.

Comments